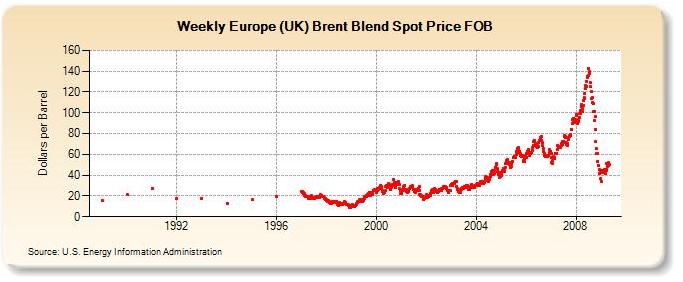

Brent oil price holds at $103, crude oil supply in focusBrent crude oil futures end the week’s trading session firm at $103 a barrel as crude oil supplies from Middle Eastern countries continues to worry many, as uncertainty holds Brent oil at two year trading highs. Brent Oil Futures – Closing Price Brent crude oil futures for April 2011 delivery ended the week’s trading session at $103.06 a barrel on the ICE Futures Exchange, which is $1.65 higher than Brent’s close last week at $101.41. Suez Canal Route Still a Concern Brent oil futures have rallied on recent protests in the Middle East, in part due to worries about oil transport to Europe through Egypt’s Suez Canal. Those gains, plus a supply glut at the US hub of Cushing, have reversed the typical relationship between ICE Brent and NYMEX WTI oil futures to

...

Read more »

Category:

Analitics

|

Views:

2352

|

Added by:

iks

|

Date:

20.02.2011

|

|

Separating the hard facts from the hype has never been

harder in the Chinese market, which is either a huge speculative

bubble, the lifeboat for the global chemical industry or anything in

between

IT NEVER gets any easier trying to work out what's happening in

China.

The country's economic rebound is sustainable and the global

recovery is just around the corner, insist some industry

sources.

Fears of an L-shaped recovery appeared to be receding as this

feature went to press. Th

...

Read more »

Category:

Analitics

|

Views:

2345

|

Added by:

iks

|

Date:

27.09.2009

|

|

Luis Viceira, George E. Bates Professor of Business Administration at Harvard Business School, interviewed by Brendan Maton, financial journalist. _____________________________________________________________________________ Is the real lesson from this crisis that liquidity was the big problem? Liquidity was not the only problem. But I think a lesson that investors have to derive from this crisis is that it is very important to be aware of what your liquidity situation or the liquidity situation of your portfolio is at any given point in time. I think some investors have learned the hard way that it is not the same thing to invest in an equity vehicle that is liquid versus an equity vehicle that is illiquid. And if you also have an illiquid portfolio and are going to have to sell it into an illiquid market, as has been the situation for ma

...

Read more »

Category:

Analitics

|

Views:

1865

|

Added by:

iks

|

Date:

30.08.2009

|

|

Notes:

Adjustments include an adjustment for crude oil, previously referred to

as "Unaccounted For Crude Oil". A negative stock change indicates a

decrease in stocks and a positive number indicates an increase in

stocks. Data may not add to total due to independent rounding. See

Definitions, Sources, and Notes link above for more information on this

table. For more details see our file Download file, or read more here Release Date: 4/30/2009 Next Release Date: Last Week of May 2009

Category:

Analitics

|

Views:

2132

|

Added by:

iks

|

Date:

09.05.2009

|

|

DUBAI (Reuters) - Contractors will have made

aggressive cuts to cost estimates in bids due later this month to build

a new refinery for Saudi Aramco and Total (TOTF.PA), sources at

contracting companies said on Thursday.

Oil's slump to around $50 a barrel from a peak

over $147 last year has forced cost cutting across the industry, and

contractors that were turning down work a year ago now find themselves

in a fierce competition for what is left, sources said. "With the current economic situation, there are not many projects," one

contractor planning to bid to build the refinery told Reuters.

"Competition is much more severe. We need to sharpen our pencils."

Top oil exporter Aramco and French energy giant

Total have said they want billions of dollars cut from the construction

costs for the refinery to reflect the slump in the prices of raw

materials since the global economic downturn took hold.

...

Read more »

Category:

Analitics

|

Views:

1591

|

Added by:

iks

|

Date:

16.04.2009

|

|

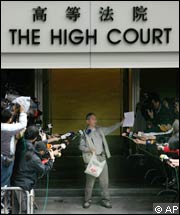

A Hong Kong court on Monday cleared Richard Li’s protracted attempt to buy out PCCW, his telecommunications company, striking down calls from the market regulator to block the $2bn deal.PCCW, his telecommunications company, striking down calls from the market regulator to block the $2bn deal. But

the Securities and Futures Commission said it would appeal against the

judge’s decision to allow the buy-out offer from Mr Li, PCCW chairman,

and China Unicom, the second largest shareholder, because of allegations of improper share transfers. In

a February meeting, minority shareholders voted in favour of a $4.50

offer. But SFC investigators moved in after the poll, seizing voting

records. In

rejecting the SFC’s arguments, Justice Susan Kwan said Monday: “I am

satisfied that the shareholders

...

Read more »

Category:

Analitics

|

Views:

1531

|

Added by:

iks

|

Date:

06.04.2009

|

|

Category:

Analitics

|

Views:

1398

|

Added by:

iks

|

Date:

19.03.2009

|

|

By John Authers, Investment editor

Published: March 19 2009 19:27 | Last updated: March 19 2009 19:27

The

shock came on Wednesday, from the Federal Reserve. The response from

almost all markets was immediate. The after-shocks on Thursday were

much harder to predict. Stocks and bonds appear to have had a

one-off adjustment to the news that the Fed would try to push down

long-term rates by buying Treasury bonds. Once these markets had had

the chance to react to the news, they quietened down swiftly. In

currencies, however, the shocks continued on Thursday and developed

their own momentum. Wednesday’s fall of 3.01 per cent for the dollar

was the greatest, on a trade-weighted basis, since the signing of the

Plaza accord in September 1985. Thursday’s fall, by the end of the trading day in London, was also very severe: about 1.9 per cent, according to Bloomberg. The

dollar had rallied since last summer largely on the perverse effects of

“de

...

Read more »

Category:

Analitics

|

Views:

1553

|

Added by:

iks

|

Date:

19.03.2009

|

|

Interview given to Pro Finance by Mitul Kotecha, Head of Global Forex Market Research at Calyon. 03.03.2009. (see statistic here>>)

EUR/USD is in a kind of consolidation after

rally which we've seen in recent trading sessions. In your opinion, how

big the potential for further upside is?

We

still believe that EUR/USD will push higher and certainly 1.60 is

likely this week, as the US economic data is continuing to disappoint

expectations in contrast with the more upbeat European data. We think

we could move above 1.60 towards 1.65, but, however, we don't see the

euro sustaining gains there in longer term. Recently among market

participants there were talks about possible ECB intervention if euro

continues to appreciate. We think it will depend on the pace of the

move and whether it will be acco

...

Read more »

Category:

Analitics

|

Views:

1063

|

Added by:

iks

|

Date:

19.03.2009

|

| |