Hello Guest

Wednesday

24.04.2024

17:14

24.04.2024

17:14

IKS-RUSSIA

| Menu |

| News area | ||||

|

| LOGIN FORM |

| News calendar | |||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||

| Search |

|

|

| FRIENDS |

| Statistics |

|

Total online: 1 Guests: 1 Users: 0 |

| Research |

Main page » 2009 » April » 6 » HK regulator to appeal PCCW decision ByJustine Lau and Tom Mitchell in Hong Kong Published: April 6 2009 07:40

HK regulator to appeal PCCW decision ByJustine Lau and Tom Mitchell in Hong Kong Published: April 6 2009 07:40 | 10:46 |

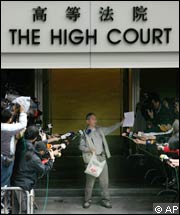

A Hong Kong court on Monday cleared Richard Li’s protracted attempt to buy out PCCW, his telecommunications company, striking down calls from the market regulator to block the $2bn deal.PCCW, his telecommunications company, striking down calls from the market regulator to block the $2bn deal. But the Securities and Futures Commission said it would appeal against the judge’s decision to allow the buy-out offer from Mr Li, PCCW chairman, and China Unicom, the second largest shareholder, because of allegations of improper share transfers. In a February meeting, minority shareholders voted in favour of a $4.50 offer. But SFC investigators moved in after the poll, seizing voting records. In rejecting the SFC’s arguments, Justice Susan Kwan said Monday: “I am satisfied that the shareholders are treated equitably in the reduction, that the proposals for reduction were properly explained, and that the reduction is for a discernible purpose.” Justice Kwan said the splitting of shares was not

banned in Hong Kong and there was no evidence that investors voted for

anything other than their wish to take profits. The SFC asked Justice Kwan to delay the transaction as it

sought to appeal but she refused. The buy-out proposal was “time

sensitive and price sensitive” and should not be subject to more

uncertainty, she said. The Court of Appeal later agreed to hold a

hearing on April 16. “It would be unfair and wrong for the SFC to ask the court to lay down, for the first time, a policy on what should or should not be followed with regard to share splitting in a scheme, and to apply the policy to the scheme on a retrospective basis. This would only lead to chaos,” she said. “We are concerned that important points of

law regarding the splitting of shares, which are of significant public

concern, have not been fully clarified,” Martin Wheatley, SFC chairman,

said. “These are important points of principle for the Hong Kong market

and the protection of minority shareholders.” After the judgment was handed down, retail shareholders erupted in protest.Monday’s

judgment is a relief for Mr Li, the son of Hong Kong tycoon Li

Ka-shing. He has tried to sell PCCW in part or in whole three times

over the past three years. Copyright The Financial Times Limited 2009 | |

| Category: Analitics | Shown number: 1454 | Added by: iks | Rate: 4.0/1 | |

| All comments are: 1 | |

|

| |